ELIGIBILTY

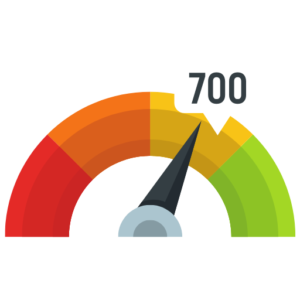

700+ CIBIL SCORE REQUIRED

OWN HOUSE NOT REQUIRED

BANK STATEMENT NOT REQUIRED

GST NOT REQUIRED

NO TURNOVER REQUIRED

NO BUSINESS PROOF REQUIRED

APPLY NOW IN 3 EASY STEPS

#1

Enter your personal, business & bank details to get a fair loan offer

#2

Accept the loan offer & complete your documentation & KYC

#3

Choose from flexible repayment options and start receiving funds

WHY CHOOSE

COMET CAPITAL

Apply in few minutes

No Branch Visit

Fast Approval

An ISO certified company

Get money in 2-4 working days

Tenure up to 60 months

Apply for your loan

Select your loan amount above and elevate your business.

Loan amount

Tenure

Interest Rate

Equated monthly installment (EMI)

Total Payable

*Starting at 1% monthly reducing interest rate. Apply now to know your exact EMI & interest rate.

Apply NowEligibilty & Documentation

WHO CAN APPLY?

CIBIL SCORE OF 700 OR HIGHER

GOOD CIBIL TRACK

BUSNIESS OPERATION FOR 1+ MONTH

OUR OFFICIAL LENDING PARTNERS

TESTIMONIALS

What My Clients Say?

Comet Capital’s unsecured loan was a game changer for my business. With no collateral needed, I received quick approval and the funds were in my account within days. Perfect for small businesses like mine

Suresh R

Chennai

The loan process was smooth and fully online. I highly recommend Comet Capital for any entrepreneur looking for fast, hassle-free funding

Priya M

Coimbatore

Amazing service! The team guided me through every step, and I secured the loan with ease. Thanks to Comet Capital, my business is growing steadily

Karthik S

Madurai

Frequently Asked Questions (FAQs)

1. What is an unsecured business loan?

An unsecured business loan is a type of loan that does not require any collateral. It allows businesses to borrow funds without risking their assets.

2. How do I apply for a business loan?

You can apply online by visiting our website and filling out the application form. The process is quick, taking only a few minutes.

3. What documents are needed to apply for a loan?

You will need your PAN Card, Aadhaar Card, and one of the following business documents: GST Certificate, Trade License, or MSME Certificate.

4. What are the eligibility criteria for a business loan?

To qualify for a business loan, your business must be operational for at least 2 years with a CIBIL score of 680 or higher.

5. How long does it take to get loan approval?

Loan approvals are instant, and funds are typically disbursed within 2 working days.

6. Is collateral required to get a business loan?

No, we offer unsecured loans, which means you don’t need to provide any collateral.

7. What is the loan tenure?

Loan tenure ranges from 12 months to 60 months, providing flexibility for repayment.

8. Are there any hidden fees?

No, there are no hidden fees. A one-time processing fee of 2-3% of the loan amount is charged.

9. Can I pre-close my loan?

Yes, you can pre-close your loan without any additional charges, and interest is calculated up to the date of closure.

10. What are the interest rates?

Interest rates range from 11.5% to 33% per annum, depending on your creditworthiness and loan amount.